How ACH Works

On this page

The ACH Network is a highly reliable and efficient, batch-oriented electronic funds transfer system that provides clearing and settlement of electronic payments. Established in the 1970s, the ACH Network processes billions of transactions a year, serving millions of businesses and consumers, as well as the federal, state and local governments. The ACH Network is governed by the Nacha Operating Rules, which determine how funds are disbursed and settled among financial institutions. Nacha manages the development, administration and governance of the ACH Network.

ACH is a batch process, store-and-forward system that provides for value-dated settlement transactions for both disbursements (credits) and collections (debits). The ACH Network electronically moves funds between accounts for consumer, business and government payments, and is a secure, cost-effective and efficient alternative to the processing of paper checks or wire transfers.

ACH is unique in its ability to both push and pull funds between various accounts. Most payment networks will only push or pull, but not both. ACH transactions can be executed on a same-day basis or be future dated to occur on a specific date.

Nacha encourages all ACH Originators and Third-Party Senders to the Nacha Operating Rules & Guidelines to ensure compliance. The Rules & Guidelines is an annual publication that provides the legal framework for the Network, as well as guidance on implementing and abiding by the Rules.

For business originators, ACH

- Provides a reliable and efficient method for transferring funds.

- Saves time and money by reducing administrative and operating expenses to process checks.

- Is a low-cost alternative to wire transfers.

- Accelerates the availability of funds.

- Allows a consumer or business to control when bills and invoices are paid.

- Improves cash management forecasting.

A Direct Deposit is a credit application that transfers funds into a consumer’s account. It can be used for receiving:

- Wages

- Travel and expense reimbursements

- Pension/401(k) disbursements

- Annuities

- Dividend and interest payments

- Social Security and other government payments

- Tax and other refunds

The advantages of using Direct Deposit include its ability to:

- Deliver availability of funds on a timely basis.

- Reduce the time and cost involved with depositing a paper check.

- Eliminate the possibility of lost or stolen checks.

A Direct Payment is a debit application that the consumer has granted another party the authority to initiate a debit to the consumer’s account. It can be used to:

- Pay monthly bills

- Donate to a charity

- Send money to a friend

- Fund an investment account

- Pay businesses for their products and services

- Make insurance, tax and homeowner association (HOA) payments

- Pay tuition

- Automatically pay mortgage, automobile payments and other loans

The advantages of using Direct Payments include its ability to:

- Eliminate check writing and postage expenses.

- Allow bills to be paid on time, eliminating the risk of late payments and avoiding late charges.

- ACH Operator: A central clearing facility that receives Entries from an ODFI, distributes Entries to the appropriate RDFI, and performs the settlement functions for the financial institutions. There are two ACH Operators: the Federal Reserve Bank and the Electronic Payments Network (The Clearing House). The two operators exchange files between each other as well.

- Originator: A consumer, business or entity that agrees to initiate transactions into the payment system according to an arrangement with a Receiver. The Originator will obtain authorization from the Receiver to transact against their account.

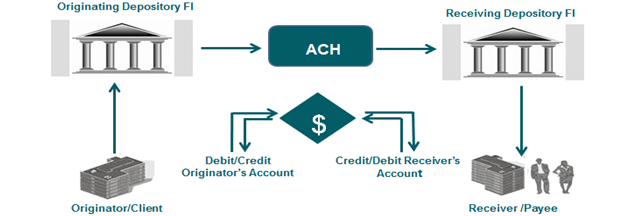

- Originating Depository Financial Institution (ODFI): A participating financial institution that receives the payment instructions from an Originator and forwards the Entries to the ACH Operator. There is an agreement between the Originator and ODFI that binds them to the Nacha Rules. The ODFI receives ACH Entries from Originators and forwards those entries to the ACH Operator.

- Receiver: A consumer, corporation or entity that has authorized an Originator to initiate an ACH Entry to the Receiver’s account with the RDFI.

- Receiving Depository Financial Institution (RDFI): A participating financial institution that receives ACH Entries from the ACH Operator and posts them to the account of its Receivers.

- Third-Party Sender: A Third-Party Sender, a subset of a Third-Party Service Provider, is an entity that transmits ACH Entries on behalf of Originators that have no contractual agreement with the ODFI.

- Third-Party Service Provider: A Third-Party Service Provider performs various ACH network functions on behalf of Originators, ODFIs, and/or RDFIs. These functions can include, but are not limited to, creation of ACH files on behalf of an Originator or ODFI or acting as a sending point or receiving point on behalf of an ODFI or RDFI.

ACH Transactions

ACH Credits: “Push” of funds from the Originator’s account at the ODFI to the Receiver’s account at the RDFI. A common ACH credit application is direct deposit of payroll.

- Originator initiates an Entry to push funds into a Receiver’s account

- Receiver’s account is credited

- Originator’s account is debited (this is considered the offset/settlement Entry)

ACH Debits: ”Pull” of funds from the Receiver’s account at the RDFI to the Originator’s account at the ODFI. A common ACH debit application is payment of an insurance premium.

- Originator initiates an Entry to pull funds from a Receiver’s account

- Receiver’s account is debited

- Originator’s account is credited (this is considered the offset/settlement Entry)

ACH Entries: Categorized as either consumer payments or non-consumer payments, depending on the account type of the Receiver involved in the transaction. As there is no consistent way to know whether an account is coded as a consumer or business account, the burden of proof is on the Originator to ensure the type of account for which they have obtained authorization.

Account Validation: There are various methods available to verify an account number is open and accepting transactions, including prenotification entries, or various external services that use various methods to validate an account number and its attributes, such as ownership and address.

Prenotification: A prenotification is a non-monetary Entry (i.e. no funds move as a result of the transaction) that precedes the first live entry. Apart from the dollar amount and transaction code, the prenotification entry should look identical to the subsequent live-dollar entries. This allows the RDFI to verify the accuracy of the account data. Prenotification entries are optional for all Standard Entry Class (SEC) Codes.

Corporate Transaction Types

Corporate transactions are ACH Entries sent between corporate, business, and other non-consumer entities, which can include various amounts of remittance information (addenda).

Corporate Credit or Debit (CCD)

A CCD entry is a single-entry or recurring ACH credit or debit originated to a corporate account. CCDs are commonly used by Originators to pay vendors, concentrate funds from outlying accounts (cash concentration), to fund payroll, petty cash, or other disbursement accounts. A CCD entry can contain a single addenda record to relay payment-related information.

Corporate Trade Exchange (CTX)

A CTX entry is a single-entry or recurring ACH credit or debit originated to a corporate account that supports up to 9,999 addenda records. CTXs are commonly used in trading partner relationships because a full ANSI ASC X12 message or payment-related UN/EDIFACT information can be sent with the CTX entry.

Consumer Transaction Types

Consumer transactions are ACH Entries sent from an Originator to consumers (individuals). The following are the most common SEC codes for consumer ACH transactions.

Prearranged Payment and Deposit (PPD)

A PPD entry is a single-entry or recurring ACH credit or debit sent by an Originator to a consumer account to make or collect a payment, where authorization is obtained in writing.

Internet-Initiated/Mobile Entries (WEB)

Internet-initiated Entries (WEB) can be either a single entry or a recurring ACH debit that takes place when the consumer’s authorization for a transfer of funds is received via the internet or mobile device.

Telephone Initiated Transactions (TEL)

Telephone-initiated Entries (TEL) can be either a single or a recurring ACH debit that occurs when the consumer’s authorization for a transfer of funds is received orally via the telephone.

Authorizations

Each Originator has the responsibility to obtain proper authorization to transact against an account. The method to prove authorization is dependent upon the payment’s SEC Code. It is the responsibility of the Originator to be able to prove that they have permission to transact with an account and be able to provide copy of that proof within 10 days of a request.

Consumer Authorizations: For consumers, a debit authorization must be in writing or similarly authenticated. The authorization must have clear and readily understandable terms. For recurring ACH Debits, the Originator must provide instructions on how a receiver can revoke authorization for future transactions.

Nacha Rules also require the Originator to notify consumer customers of any changes in date or amount debited. The Rules require:

- A seven calendar-day notice for a change of date (consumer and corporate).

- A 10 calendar-day notice for a change of amount (consumer only).

Note: For businesses, there must be an agreement between the two business partners. The Rules do not specify what must be in the agreement, other than both parties must be bound to the Rules.